What rate can I expect on refinancing a rental property - 1 percent above par?

The question: “What rate can I expect on refinancing a rental property - 1 percent above par?”

The rate doesn’t have to be effected at all. Simply use the chart below to determine the investment property adjustment or “add-on”…and pay it as discount points directly to the lender. The rate will remain par if you negotiated a par rate in the first place.

Investment Property Adjustments:

< =75% LTV: add 1.5

75.01-80% LTV: add 2.00

80.01-90% LTV: add 2.50

These are only the add-ons for the added risk of investment property.

Of course, you may have additional risk-based add-ons if you intend a cashout refinance over an above what you see here.

For example, if your loan to value is between 60-75%, your credit score is between 600-620, and you're asking for a cashout refinance, the addition risk-based add-on for cashout is 1.75%.

Total add-ons would then be 1.75% plus the investment property add on of 1.5% for a total of 3.25% to get a par rate. You can see as your credit score drops and your LTV rises, the greater the add-on.

(Note: If your credit scores are better, this would lower the add ons so it works both ways. This makes it imperative to know all three credit scores before shopping for a mortgage.

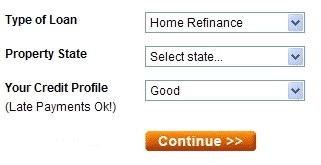

Here is the best way to do that...

You could allow the rate to pay this 3.25%with what is called YSP.But it gets really costly and over the long haul even more so.To estimate the rate increase needed to produce 3.25 YSP points you can say for every.375%in rate over par you accept,1

YSP point is created that you can use to offset add-ons.If par was 6.25%and you are willing to accept 1.5%(that is 4 x.375%)over par or 7.75%,you’d have 4 YSP points to pay add-ons and other closing costs.

To fully understand YSP or yield spread premium…read everything in our Category-Yield Spread Premium

Also as an investor obtaining the best rate on the mortgage is paramount for cashflow and I highly recommend you learn just how to go about it correctly…as you can see,it gets a little tricky.We outline the best strategy in ourFree Tools…click the link to learn more.

Great question!

UPDATE 10/10/2008

add ons for investment properties changed to the following:

less than 75%LTV 1.75

75%to 80%LTV 3.00

more than 80%LTV 3.75

Previous Post:« Should I refinance consolidating my current first mortgage and my home equity loan?

Next Post:» Should I refinance my ARM into a fixed rate mortgage now or wait?

Tags: Better Credit Score • Cashout Refinance • Investment Property Refinancing • Par Rate • Rate Adjustments

Leave a Reply